What is

cho

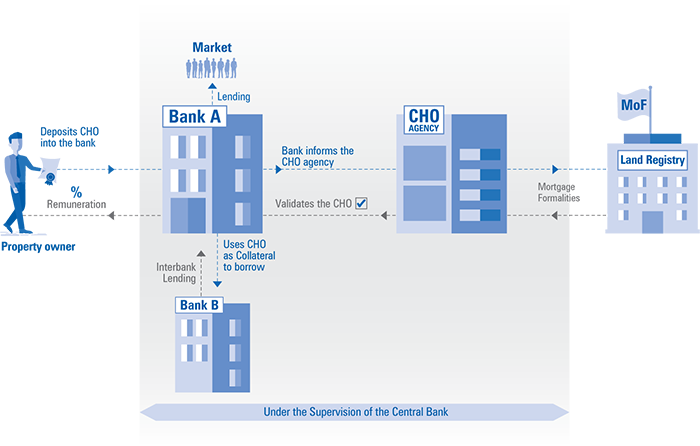

- CHO stands for Certificat Hypothécaire Obegi in French.

- It is a real estate guarantee certificate which you deposit in a bank on a short-term basis (1 to 12 months).

- It works just like depositing cash, but instead of receiving interest on your cash, you earn a fee on your CHO.

- This guarantee certificate will be used by the bank to borrow more efficiently through the interbank market while using its pool of CHOs as collateral, and therefore lend more easily.

CHO

Operational model

-

The system relies on:

- A new banking instrument: the CHO

- An integrated database: the Agency

- Significant wealth: the country’s real estate assets

The Agency

At the core of the system, the Agency is in direct contact with banks and real estate civil service administrations.

It is supervised by the regulatory authorities

Its tasks include:

- Valuating all eligible real estate assets according to the ‘Standard Valuation’ process

- Registering and releasing the guarantees

- Reporting transactions to all stakeholders

Real Estate Assets

Total value is equal to many times the GDP

Are eligible if properly registered and included by the relevant regulatory authorities in the framework of the CHO system

The

Benefits

The CHO instrument could have major positive implications for each of the parties involved, namely, the Real Estate Owners, The Economy, The State and the Banks.

For the economy

![]()

![]()

An acceleration of economic growth

![]()

![]()

A fostering of banking credit

![]()

![]()

Enhanced access to finance

![]()

![]()

Further regularization of the real estate sector

For the state

![]()

![]()

An increase in tax revenues

![]()

![]()

Additional income generated by public sector real estate assets

![]()

![]()

An improvement in the state’s borrowing capacity

For real estate owners

![]()

![]()

Better information on owned real estate assets

![]()

![]()

A steady progression in the value of owned real estate assets

![]()

![]()

Additional revenues

![]()

![]()

More banking products and services, including better access to credit

For the banking sector

![]()

![]()

A quasi-liquidity

![]()

![]()

A significant decrease in the costs of mortgage loans

![]()

![]()

Access to the Agency’s database (a source of commercial information)

![]()

![]()

A widening in the customer base and the range of products and services

The

Risks

Systemic Risk:

The systemic risk could occur in the case of a bankruptcy of the depositary bank. This might cause a ripple effect in the real estate market.

Asset Inflation

In the absence of regulation, there is a risk of real estate inflation.

Inflation

Inflation pressure might occur if the economy were to grow too fast, causing higher consumption and price increase.